Investors Haven’t Felt This Good About the Stock Market Since 2021

Is This about Trump or the GOP sweep in Congress?

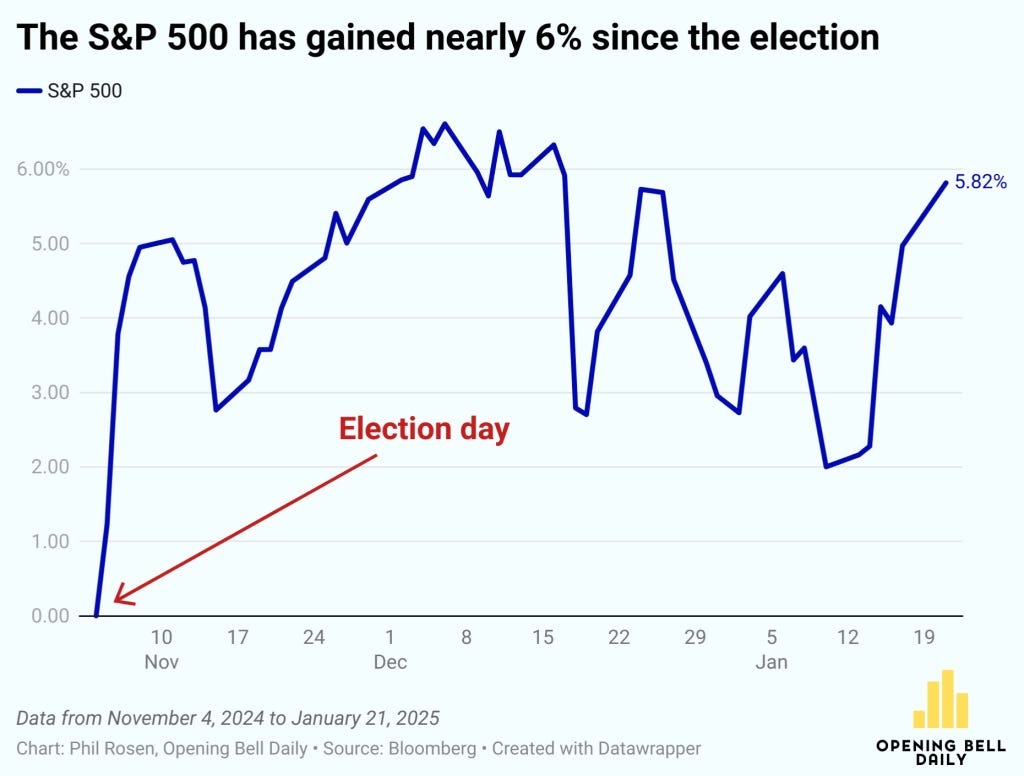

Investors are signaling a serious vote of confidence in President Trump’s stewardship of financial markets.

Global fund managers are so bullish on the new administration that they are holding the lowest level of cash in almost four years, according to Bank of America’s latest global fund manager survey.

So far in January, the firm’s clients’ biggest allocation is squarely in U.S. equities, while investors have left just 3.9 percent to cash—the lowest since June 2021.

This finding illustrates businesses have more faith in stocks than cash. It should not be surprising since inflation deflates the dollar.

In any case, institutional enthusiasm for stocks remains high. Forty-one percent of BofA clients are overweight global stocks, while investors cut allocations to bonds to the lowest since October 2022.

Here are the three most crowded trades:

Magnificent Seven Amazon, Tesla, Meta, Apple, Microsoft, Alphabet, and NVIDIA

When asked which asset class will be the top performer in 2025, 27 percent of fund managers said U.S. equities, followed by bitcoin at 14 percent.

There are no healthcare industries in the Magnificent Seven, Health care despite its huge dominance in the GDP (17%) is a risky business, with the United Health Cares fiasco in prior authorization. Healthcare is a tightly regulated sector of the economy.