What Would Happen to Insurers If Physicians Have Codes to Document Delayed, Changed or Abandoned Care Due to Insurer Prior Authorization Rationing?

The recent passing of the CEO of UnitedHealth Group (UHG), one of the largest healthcare companies in the world, has sent shockwaves through the business community and the healthcare sector. As news of his death broke, tributes poured in from colleagues, industry leaders, and the public, highlighting his profound impact on healthcare and the lives of millions.

This singular event will have no direct effect on the folly of the American health system. Time will tell if the hard crust of the system has been pierced for all to see.

It is not a surprise to anyone who has insurance what has occurred. There have been disturbing reactions to his murder.

The reaction to the death of a prominent figure like the CEO of UnitedHealth Group (UHG) can be complex, leading to mixed feelings among different groups of people. Here are some reasons why some individuals might express relief or gladness regarding his passing:

1. Controversial Policies

Some may view the CEO's policies and business practices as detrimental to healthcare accessibility or affordability. Those who felt negatively impacted by UHG’s strategies might feel vindicated by his death.

2. Corporate Influence

UHG, being a major player in the healthcare sector, has considerable influence over industry standards and practices. Critics of corporate healthcare might welcome a change in leadership as an opportunity for potential reform.

Individuals directly affected by UHG’s decisions—whether employees, patients, or partners—may hold personal grievances against the leadership, leading to a sense of relief at his passing.

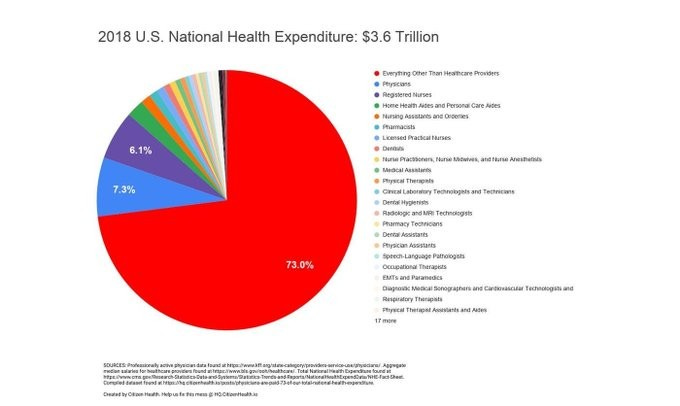

Fueling the crisis: The chart above is a representation of the amount each segment of the pie goes to the internal workings of the system.

There are many unanswered questions about UHG. Why is their denial rate so much higher than other insurance companies?

UnitedHealthcare (UHG)

In 2023, UnitedHealthcare had a claim denial rate of approximately 32%, which is notably higher than the industry average of 16%. This means that UHG dismissed about one in every three claims, raising concerns about their claims processing practices [1][2].

Blue Shield

Specific denial rates for Blue Shield were not detailed in the search results. However, it is generally understood that denial rates can vary by region and specific plans offered under the Blue Shield brand. For a precise figure, it would be advisable to consult specific reports or studies focusing on Blue Shield's performance.

Aetna

Similar to Blue Shield, Aetna's specific denial rates were not provided in the search results. Aetna, like other insurers, may have varying denial rates depending on the type of claims and the specific policies in place. Again, consulting industry reports or consumer advocacy studies would provide more detailed insights.

Why is there a lack of transparency about the denial rates of Blue Shield and Aetna?

Congress is feeling the pressure now regarding intended legislation in progress.

Overview: Several bills have been proposed to streamline and reform the prior authorization process, which is often cited as a reason for claim denials.

Impact on Denials: These reforms aim to reduce unnecessary delays and improve patient access to care by making the process more efficient.

The House bill aimed at reforming prior authorization is H.R. 3107, known as the "Improving Seniors' Timely Access to Care Act."

H.R.3107 Key Points

Streamlining Prior Authorization: The bill seeks to simplify the prior authorization process for Medicare Advantage plans, reducing administrative burdens on healthcare providers.

Transparency Requirements: It mandates that insurers provide clear, timely information regarding which services require prior authorization and the criteria used for these decisions.

Expedited Processes: The bill proposes expedited review processes for urgent care situations, ensuring that patients receive timely access to necessary treatments.

Data Reporting: Insurers would be required to report data on prior authorization requests and denials, promoting accountability and oversight.

Feedback Mechanisms: It includes provisions for healthcare providers to give feedback on the prior authorization process, helping to identify areas for further improvement.